In the digital age, electronic payments have become increasingly popular due to their convenience and efficiency. One of the innovative features that has revolutionized the way we make payments is the use of QR codes. QR codes, or Quick Response codes, are two-dimensional barcodes that can be scanned by smartphones and other mobile devices. They store information that can be quickly and accurately read, making them ideal for facilitating transactions. Revolut, a leading financial technology company, has incorporated QR code technology into its platform to simplify and streamline the payment process for its users. With Revolut’s payment QR code feature, users can make secure and instant payments by scanning a QR code displayed by the recipient.

Using the payment QR code feature on Revolut is incredibly straightforward. When making a payment, users simply need to open the Revolut app on their mobile device, navigate to the payment section, and select the “Scan QR Code” option. The device’s camera will then be activated, allowing users to scan the QR code displayed by the recipient. Read the following article curated by Trendingcult to learn more about the best payment QR code, QR code payment and Touch-free payments.

Understanding Payment QR Codes

Payment QR codes have rapidly gained popularity due to their simplicity and convenience. These codes contain encrypted information such as the recipient’s account details, payment amount, and other relevant transaction data. By scanning the QR code using a smartphone’s camera, users can initiate payment directly from their mobile banking or payment apps. This eliminates the need for manual entry of account information, reducing errors and saving time.

How Payment QR Codes Work

When making a payment using a QR code, the process is seamless. Users simply open their preferred payment app, select the option to scan a QR code, and point their device’s camera at the code displayed by the recipient. The app then decodes the QR code and automatically populates the payment details, including the recipient’s account information and the payment amount. Users can review the details, confirm the payment, and authorize the transaction with a few taps on their devices.

The Benefits of Payment QR Codes

Enhanced Efficiency

Payment QR codes significantly improve the efficiency of financial transactions. The elimination of manual data entry reduces errors, minimizes the time required to complete transactions, and enhances the overall user experience.

Simplified Checkout Process

For businesses, payment QR codes simplify the checkout process, particularly in retail stores and restaurants. Customers can quickly scan the code and complete their payment without the need for cash or physical cards, leading to faster transactions and shorter queues.

Secure Transactions

Payment QR codes offer enhanced security by ensuring that payments are sent to the intended recipient. The encrypted information within the code ensures that sensitive payment details remain protected, reducing the risk of fraud and unauthorized access.

Versatility and Integration

Payment QR codes can be integrated into various platforms and payment systems, making them versatile and widely applicable. They can be used in physical stores, online platforms, peer-to-peer transfers, and even charitable donations, providing a seamless payment experience across different contexts.

Use Cases of Payment QR Codes

- Retail and E-commerce: Many retail stores now incorporate payment QR codes into their point-of-sale systems. Customers can complete purchases by simply scanning the code at the checkout counter, eliminating the need for physical cards or cash. E-commerce platforms also use payment QR codes to simplify online transactions and improve user convenience.

- Peer-to-Peer Payments: Payment QR codes facilitate peer-to-peer transactions, enabling friends, family, or colleagues to transfer funds quickly and securely. Whether splitting a bill at a restaurant or paying rent, users can scan the QR code and transfer the required amount within seconds.

- Transportation and Ticketing: Payment QR codes are widely utilized in the transportation industry for ticketing purposes. Airports, train stations, and bus terminals use QR codes to streamline the ticketing process, reducing paper waste and improving efficiency.

- Charitable Donations: Non-profit organizations and charities have embraced payment QR codes as a way to receive donations conveniently. By displaying QR codes on their websites, social media, or physical marketing materials, these organizations can encourage supporters to contribute easily.

The Future of Payment QR Codes

As technology continues to advance, the future of payment QR codes looks promising. With the increasing adoption of mobile payments and the integration of QR code functionality in various apps and devices, the use of payment QR codes is expected to grow exponentially. Furthermore, emerging technologies such as blockchain and cryptocurrency are exploring the integration of QR codes for secure and seamless digital transactions.

Conclusion

Payment QR codes have revolutionized the way we make financial transactions. Their simplicity, efficiency, and versatility have made them a preferred method for both individuals and businesses. By eliminating the need for manual data entry and offering enhanced security, payment QR codes have streamlined the payment process and improved the overall user experience. As we move further into the digital age, payment QR codes are likely to play an increasingly prominent role in our daily lives, transforming the way we handle transactions and interact with financial systems. Follow Trendingcult for more.

FAQs

How do I make a QR code payment?

Making a QR code payment is a straightforward process that involves a few simple steps:

Step 1: Ensure you have a smartphone or mobile device with a QR code scanning capability. Most modern smartphones have built-in QR code scanners in their camera apps, or you can download a QR code scanning app from your device’s app store.

Step 2: Open your preferred mobile banking or payment app on your device. It could be your bank’s official app, a third-party payment app, or a specific app provided by the merchant or service provider you wish to make a payment.

Step 3: Navigate to the payment or transaction section within the app.

Step 4: Look for the option to “Scan QR Code” or similar wording. Select this option, which will activate your device’s camera.

Step 5: Align your device’s camera with the QR code displayed by the recipient. Ensure that the QR code is within the camera’s viewfinder, and the app will automatically detect and scan the code.

Step 6: Once the QR code is scanned, the payment details, including the recipient’s account information and payment amount, will be populated in the app.

Step 7: Review the payment details to ensure accuracy. If everything is correct, confirm the payment within the app. Depending on the app and the payment method you’re using, you may need to provide additional authentication, such as a PIN or biometric verification.

Step 8: After confirming the payment, the transaction will be processed, and you will receive a confirmation of the successful payment.

Can you take payments on a QR code?

QR codes offer a secure and convenient payment method for merchants and service providers. Customers scan the QR code, enter payment details, authorize, and receive confirmation. Payment processing involves transmitting details to the service provider, who verifies the transaction. Processes and methods may vary depending on service provider or platform, and countries may have specific QR code payment standards.

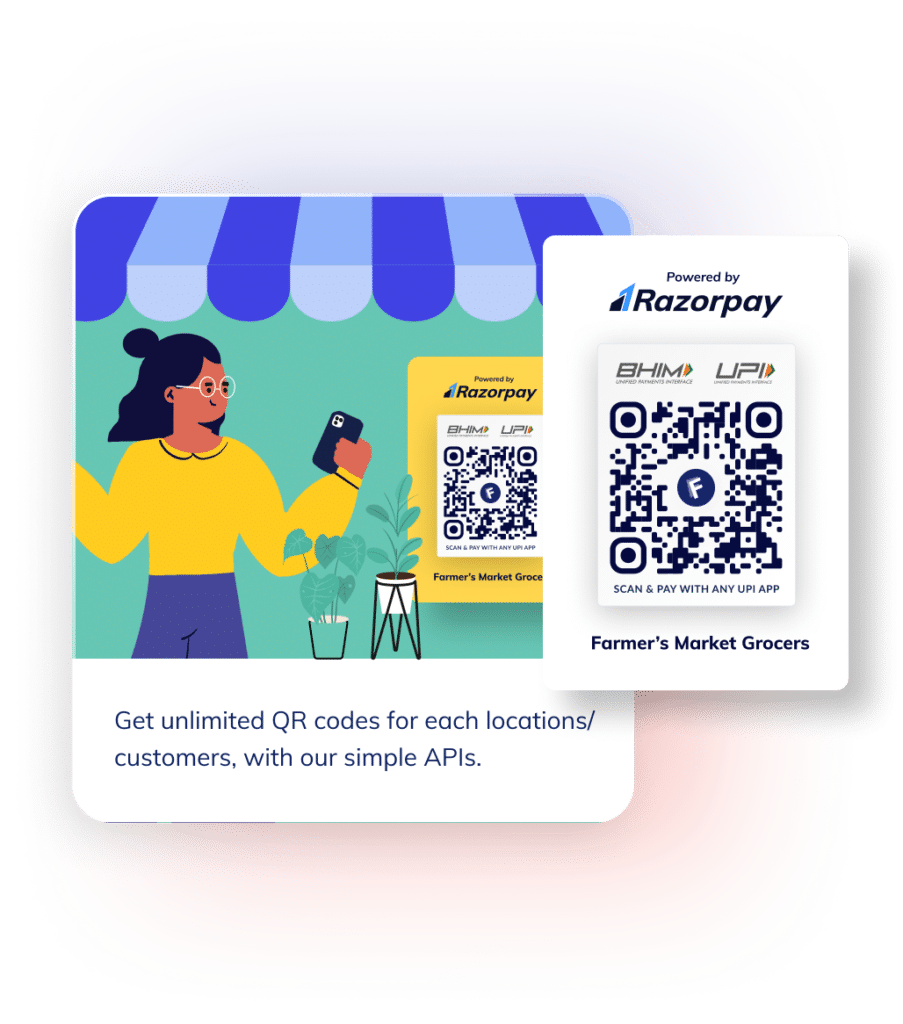

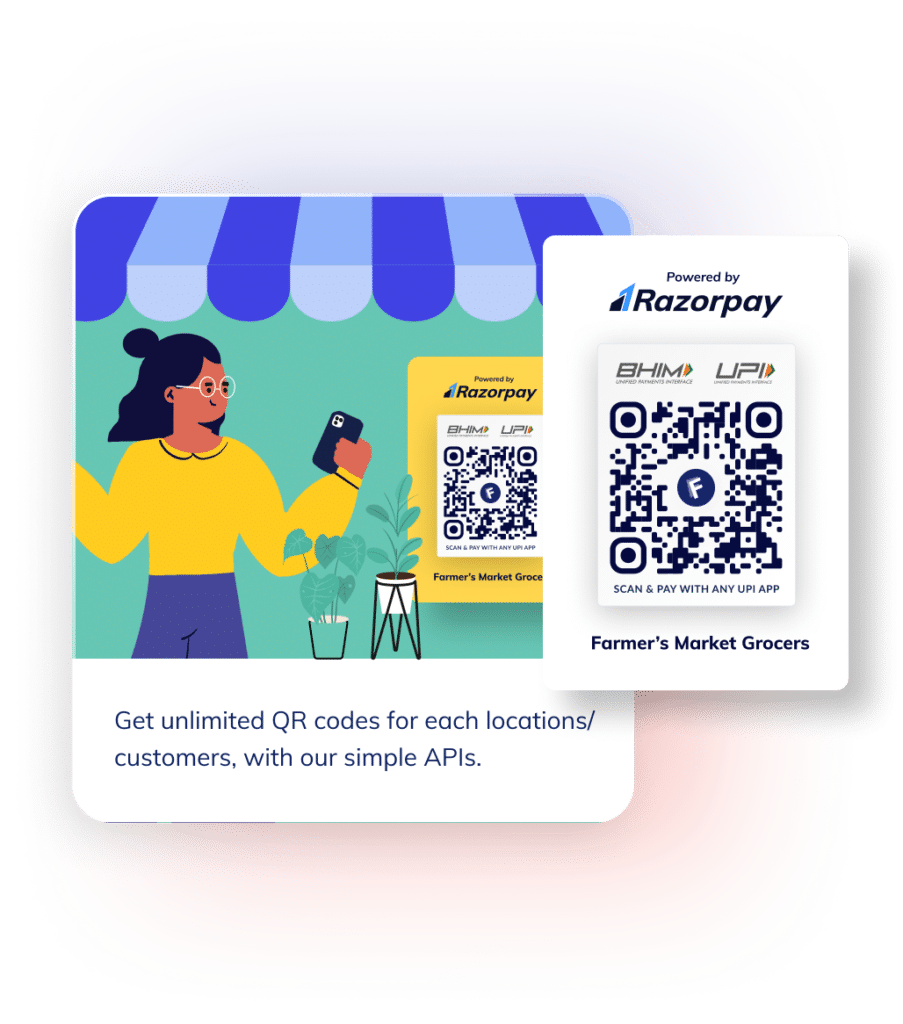

How do I create a QR code for UPI payment?

To create a QR code for UPI (Unified Payments Interface) payment, follow these steps:

Step 1: Ensure that you have a UPI-enabled app on your smartphone. Popular UPI-enabled apps include Google Pay, PhonePe, Paytm, and BHIM (Bharat Interface for Money).

Step 2: Open the UPI-enabled app and log in to your account or set up a new account if you haven’t already.

Step 3: Navigate to the payment section or the option to send money within the app.

Step 4: Look for the option to create or generate a QR code for receiving payments. In most UPI-enabled apps, this option is easily accessible within the payment or transaction menu.

Step 5: Select the option to create a QR code and specify the payment details you want to include, such as the payment amount or a reference note.

Step 6: Once you have entered the necessary information, the app will generate a QR code specifically for UPI payments.

Step 7: You can save the QR code as an image, display it on a screen, print it on physical materials, or share it electronically via email or messaging apps.

Step 8: When someone wants to make a UPI payment to you, they can use their UPI-enabled app to scan the QR code you provided. The payment details will be automatically populated in their app, and they can confirm and complete the transaction.